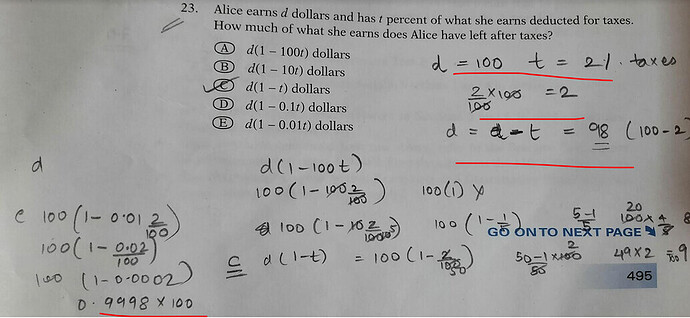

I considered d = 1000 and t=2% when I solved the options I got the answer as C but the right ans is E

Remember that t% is 0.01t. So instead of saying 1000 (1 - 2/100), (where you convert 2% as 0.02), it should actually have been 1000 (1 - 2). In other words, t is between 0 and 100, not 0 and 1.

Your working assumed that t was not a percentage.

I don’t know if the above answer made you clear or not in case if u need more explanation do reply to this message.

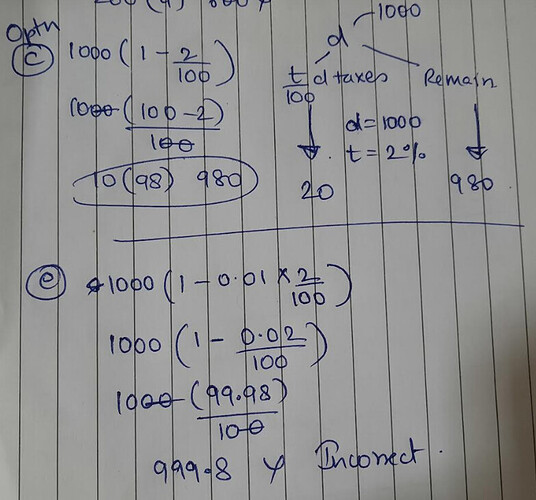

Oh yea that could be the mistake so for C the ans would be negative right coz it would be 1000 * (1-2)

I followed it but I had a query

Considering my values C the ans would be negative right coz it would be 1000 * (1-2)

coz here I am considering t as 2

hmm so the thing is let me try giving this way

- Method without plugging in values- so we need to find the amount after deduction of tax right? so assume initial amount earned be d dollars and the t percent of what she earned can be written as t%(d) and so dollars after tax is d - t%(d) (initial amount - after deduction= remaining amount). Now u know d(1-0.01t) dollars.

2)In case if u ask me the method which u did that is plugging values for option E its not 1000(1-2) its actually 1000(1-2%) which is 980. And so it will satisfy the assumed plugin numbers.